I'm going to help you take control of your money

Child Trust Fund

You have a savings/investment account called a Child Trust Fund, and at age 18 you can access the money or choose to keep it invested

The Child Trust Fund (CTF) is a long-term tax-free savings/investment account for children born in the UK between 1 September 2002 and 2 January 2011. Almost all children within this age range have their own individual account set up under Government arrangements, opened by their parents/guardian or HMRC with an initial payment from the Government.

The key purpose of the account was, and is, to establish a savings habit among children and young people: providing a cushion of financial assets as they embark on adult life, and enabling them to be confident in the management of their finances.

If you were born in the UK between 1st September 2002 and 2nd January 2011, you will almost certainly have a Child Trust Fund. It's a pot of money put into an account for you personally, either via your parents/guardian or directly by HMRC

What it's worth now depends on three things:

- How much the Government put in: this was typically between £250 and £1,000;

- Whether anyone else put money in, perhaps your local authority, or a member of your family;

- How much it's grown in value over the years.

The money is in an individual account held safely for you with a Child Trust Fund provider and The Share Foundation, a registered charity appointed by the Department for Education, has been overseeing it for you as 'registered contact'.

Most of the accounts were invested in the stock market, and will have grown significantly in value. Some were held as cash deposits and, because interest rates have been so low, these will not have seen so much growth.

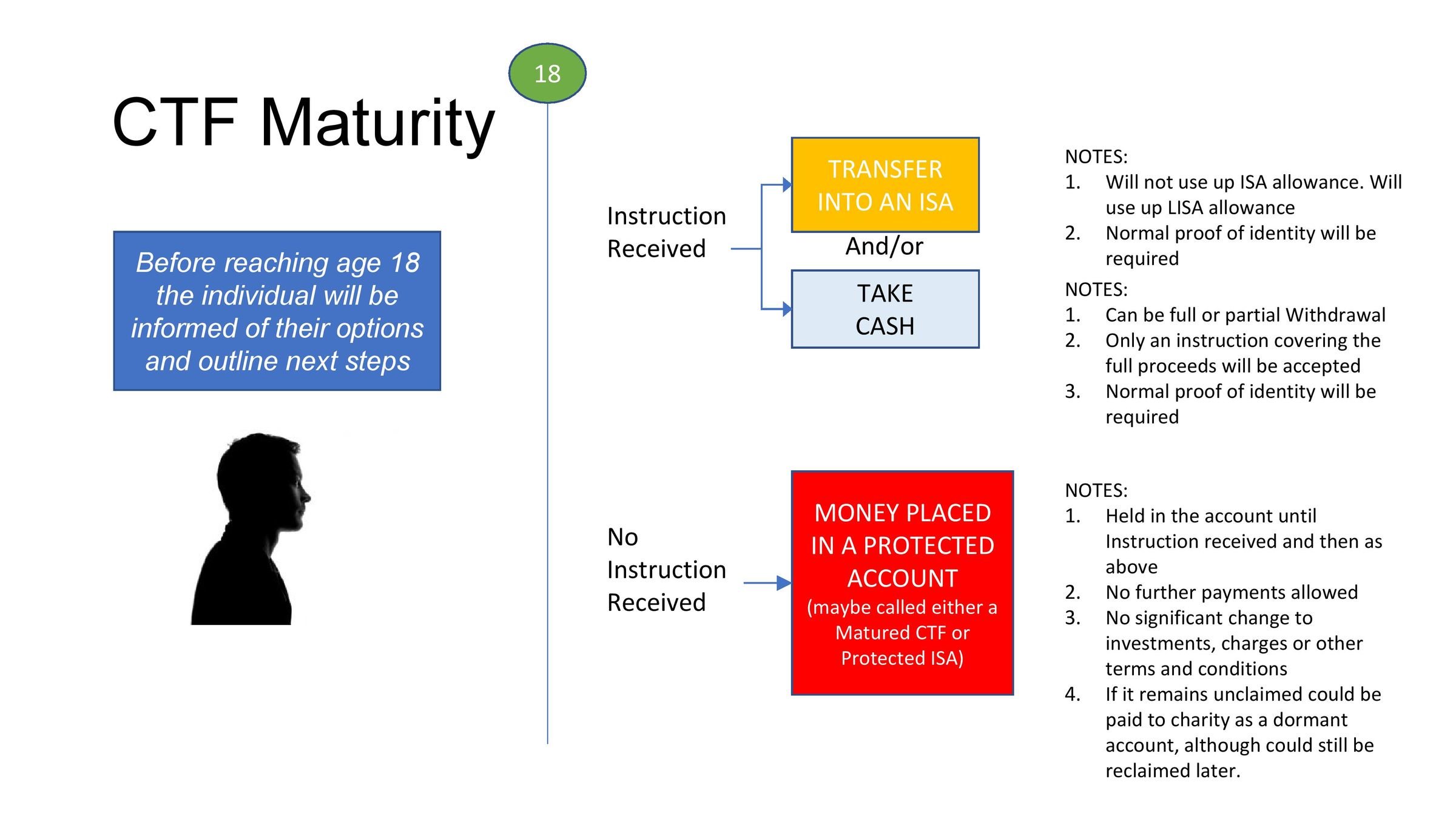

The money is yours, and now is the time to start preparing to control the account yourself. The money can be withdrawn when you reach 18, or you can leave it to grow in value. But you do need to act now.

When you then contact your account provider, they'll need to check your identification to make sure that they're talking to the right person.

Then they'll ask you what you want to do with your account when you're 18.

- Firstly, go to https://MyCTF.sharefound.org

- Complete your contact and other details so that The Share Foundation can pass them to your account provider

- The account provider will then write to you directly

This is why you must take action!

Don't let your money end up in the red box!

Make sure you're happy with how it's invested.

For example:

- If you're likely to keep it invested after your 18th birthday it might make sense to leave it in an investment fund, if it's already in one;

- If you're likely to draw the money out at 18, you might prefer to put it in cash now in case market prices fall between now and then;

- Or - you might prefer to learn about investing and choose the investments yourself, in which case you might need to transfer the account to an account provider who offers self selection;

- Or you might prefer to transfer it to a Junior ISA, another type of savings account.

Lots of choices! Welcome to the new world of investing ...

Finally, The Share Foundation wants to help you get more familiar with money: there's a special course called the 'Stepladder of Achievement' designed to make it easy to learn about money. Here's your link to registering with the Stepladder programme.

There's also a web-page with a simple summary for handling your finances, and it's full of links to other resources.

This presentation has been prepared by The Share Foundation, 1st Floor, Ardenham Court, Oxford Road, Aylesbury, Bucks HP 19 8HT

Registered charity no. 1108068